This fall, Mater Christi School launched a Financial Literacy elective. The program prepares middle school students for life choices by teaching financial mindfulness and responsibility. Sixth, seventh, and eighth graders are learning how to be smart consumers, manage money, and plan for the future. Concepts and skills covered in this weekly class include: spending vs. saving, banking/payment types, building a budget, credit, and borrowing, saving and investing, spending wisely, protection from fraud, and planning for the future.

This fall, Mater Christi School launched a Financial Literacy elective. The program prepares middle school students for life choices by teaching financial mindfulness and responsibility. Sixth, seventh, and eighth graders are learning how to be smart consumers, manage money, and plan for the future. Concepts and skills covered in this weekly class include: spending vs. saving, banking/payment types, building a budget, credit, and borrowing, saving and investing, spending wisely, protection from fraud, and planning for the future.

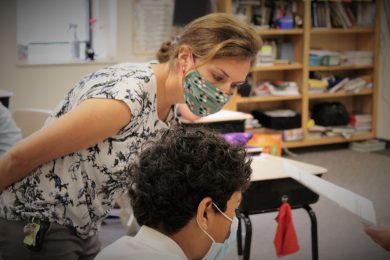

I am excited to be teaching financial literacy to middle school students because this is the time in their lives when they begin to acquire small amounts of money. Whether it is cash birthday gifts, babysitting jobs, or a regular allowance, teens are eager to begin experimenting with what to do with that income. I hope that this course will empower my students to take the first steps in making smart personal finance decisions.

The students have been incredibly curious about the topics covered, and we usually run out of class time each week to answer all of their excellent questions! They are excited to learn about a skill set that is fairly new to them. They seem to be treating the course as an important life skill that will help them make both short-term decisions (like how to spend their weekly allowance) to long-term decisions (such as allocating money for a large purchase or planning for their education).

The students have been incredibly curious about the topics covered, and we usually run out of class time each week to answer all of their excellent questions! They are excited to learn about a skill set that is fairly new to them. They seem to be treating the course as an important life skill that will help them make both short-term decisions (like how to spend their weekly allowance) to long-term decisions (such as allocating money for a large purchase or planning for their education).

Jonnie Moorhead

Math Specialist